Insurance

Health Insurance: Securing Your Future with Smarter Coverage

Introduction

Health insurance is more than just a financial product—it is a safeguard that protects individuals and families from unexpected medical expenses. In today’s world, where healthcare costs continue to rise, having reliable health insurance coverage is not a luxury but a necessity. Understanding how health insurance works, what types are available, and how to select the right plan can make a world of difference in both your health and financial well-being.

This article provides a comprehensive look at health insurance, covering everything from its importance and types to tips on maximizing benefits, ensuring you make informed choices for your future.

What is Health Insurance?

Health insurance is a contract between you and an insurance provider that helps cover the cost of medical care. In exchange for a regular premium, the insurer provides partial or full financial protection against hospital stays, doctor visits, prescriptions, and other healthcare expenses.

The primary goal of health insurance is to reduce the financial burden of medical emergencies and ensure you can access the care you need without delay.

Importance of Health Insurance

Financial Protection

Medical bills can quickly escalate, and without insurance, you may find yourself facing overwhelming debt. Health insurance covers a significant portion of these expenses, protecting your savings.

Access to Quality Care

With a good health insurance plan, you have access to a wide network of doctors, specialists, and hospitals. This ensures timely and quality treatment.

Preventive Services

Many health insurance plans include preventive care like vaccinations, screenings, and annual check-ups at no additional cost, helping you detect issues early.

Peace of Mind

Knowing you and your family are protected against unforeseen medical expenses brings invaluable peace of mind.

Types of Health Insurance

Individual Health Insurance

Designed for a single policyholder, this plan covers personal medical expenses and can be customized according to age, health, and income.

Family Floater Insurance

This plan covers the entire family under a single sum insured. It is cost-effective and ensures that any family member can utilize the benefits.

Group Health Insurance

Often provided by employers, group plans cover employees and sometimes their families. They usually come at lower premiums but may have limited coverage.

Critical Illness Insurance

This type of plan pays a lump sum if you are diagnosed with severe illnesses like cancer, stroke, or heart disease.

Senior Citizen Health Insurance

Tailored for older adults, these plans focus on age-related health concerns and provide extended coverage for pre-existing conditions.

Key Components of Health Insurance

Premium

The amount you pay monthly or annually to keep the policy active.

Deductible

The portion you must pay out of pocket before insurance coverage begins.

Co-payment

A fixed amount you pay for specific services, such as doctor visits or prescriptions.

Network Hospitals

Hospitals and clinics that partner with your insurer to provide cashless treatment.

Sum Insured

The maximum amount your insurer will cover in a policy year.

Choosing the Right Health Insurance Plan

Assess Your Needs

Evaluate your health history, family size, and future risks before selecting a plan.

Compare Coverage

Don’t just focus on premiums—compare benefits, inclusions, and exclusions.

Check Network Hospitals

Ensure your preferred hospitals and doctors are within the insurer’s network.

Understand Policy Terms

Read the fine print carefully, especially clauses regarding pre-existing conditions and waiting periods.

Look for Add-ons

Consider additional riders such as maternity cover, critical illness cover, or accident benefit.

Benefits of Health Insurance

- Coverage for hospitalization expenses

- Cashless claim options

- Tax benefits under local regulations (such as Section 80D in India)

- Coverage for pre- and post-hospitalization costs

- Protection against lifestyle diseases

Common Misconceptions About Health Insurance

“I’m Young and Healthy, I Don’t Need Insurance.”

Accidents and sudden illnesses can happen to anyone. Insurance is about preparation, not prediction.

“Employer Coverage is Enough.”

Company-provided insurance often ends with employment. Having personal coverage is essential for long-term security.

“All Policies Cover Everything.”

Every plan has limitations. Always review exclusions before signing up.

Challenges in Health Insurance

- Rising premiums with age

- Complex paperwork and claim processes

- Limited coverage for pre-existing diseases

- Misunderstanding of terms and conditions

Despite these challenges, health insurance remains a cornerstone of financial planning.

Tips to Maximize Your Health Insurance

- Choose higher coverage early in life when premiums are lower.

- Opt for cashless hospitalization whenever possible.

- Maintain transparency about medical history.

- Renew policies on time to avoid lapses.

- Review and upgrade your plan regularly.

The Future of Health Insurance

With advancements in technology, health insurance is evolving. Digital platforms make buying and managing policies easier, while wellness programs and telemedicine are increasingly being integrated into coverage. The focus is shifting toward preventive healthcare rather than just treatment.

Conclusion

Health insurance is not just a policy—it is a vital shield against medical and financial crises. By understanding the types, features, and benefits of health insurance, you can make informed choices that secure both your health and financial stability. Investing in the right plan ensures you and your loved ones can access quality care without worrying about expenses.

Insurance

Home Insurance: Protecting Your Property and Peace of Mind

Introduction to Home Insurance

Home insurance is more than just a financial product—it is a safety net that protects homeowners against unforeseen risks. Whether you own a house, apartment, or condo, your property is one of your most valuable assets. Home insurance provides coverage for damages caused by fire, theft, natural disasters, or liability claims, ensuring that you and your family are financially secure when life takes an unexpected turn.

In today’s uncertain world, having the right home insurance policy is not only wise but essential. From safeguarding your belongings to offering liability protection, it provides peace of mind knowing you are prepared for any challenge.

What is Home Insurance?

Home insurance, sometimes referred to as homeowner’s insurance, is a contract between the policyholder and the insurance provider. The policy outlines specific risks that are covered, including property damage, personal belongings, and liability protection. It ensures that in the event of a disaster, the homeowner can recover without facing overwhelming financial burdens.

Why is Home Insurance Important?

Home insurance plays a critical role in financial planning. Without it, homeowners could face devastating losses after incidents such as fires, floods, or theft. Moreover, most mortgage lenders require borrowers to have insurance before approving loans, making it a legal and financial necessity.

Types of Home Insurance Coverage

1. Dwelling Coverage

This covers the physical structure of your home, including walls, roof, and attached structures like garages.

2. Personal Property Coverage

Protects belongings such as furniture, electronics, and clothing in case of theft or damage.

3. Liability Protection

Covers legal costs if someone is injured on your property or if you accidentally damage another person’s property.

4. Additional Living Expenses (ALE)

If your home becomes uninhabitable due to a covered loss, ALE covers the cost of temporary living arrangements, including hotel stays and meals.

5. Optional Add-Ons

Some insurers offer additional protection, such as flood insurance, earthquake coverage, or protection for valuable items like jewelry or art.

Factors That Affect Home Insurance Premiums

Insurance companies determine premiums based on various factors:

- Location of the Property: Homes in disaster-prone areas often cost more to insure.

- Home Value and Construction: The size, age, and materials used in building your home affect repair costs.

- Security Features: Homes with alarms, smoke detectors, and surveillance systems may qualify for discounts.

- Claims History: A history of frequent claims may lead to higher premiums.

- Deductible Amount: Higher deductibles usually result in lower premiums but require more out-of-pocket expenses in case of a claim.

How to Choose the Right Home Insurance Policy

- Assess Your Needs: Evaluate your home’s value and belongings to determine the right coverage.

- Compare Providers: Look beyond cost; review customer service, claim processes, and coverage limits.

- Check Exclusions: Carefully read the policy to understand what is not covered.

- Seek Discounts: Many insurers offer discounts for bundling home and auto insurance or installing security systems.

- Review Annually: Your needs may change over time; always update your policy to reflect new risks or assets.

Benefits of Having Home Insurance

- Financial Security: Prevents significant out-of-pocket expenses during emergencies.

- Peace of Mind: Offers assurance that your home and belongings are protected.

- Legal Protection: Covers liability if you are sued for accidents occurring on your property.

- Mandatory Requirement: Needed to secure a mortgage from most lenders.

Common Misconceptions About Home Insurance

- “It Covers All Disasters” – Standard policies often exclude floods or earthquakes unless purchased separately.

- “Renters Don’t Need It” – Even if you don’t own your home, renters insurance is crucial to protect personal belongings.

- “It’s Too Expensive” – Policies can be customized to fit budgets, and discounts are often available.

Tips to Lower Home Insurance Costs

- Bundle insurance policies with the same provider.

- Increase your deductible if financially feasible.

- Maintain a good credit score.

- Invest in home security systems.

- Avoid filing small claims to keep premiums lower.

Conclusion

Home insurance is not just about protecting a property; it is about ensuring stability, security, and peace of mind for you and your loved ones. By understanding the types of coverage, factors influencing premiums, and ways to choose the right policy, homeowners can make informed decisions that safeguard their future.

In a world filled with uncertainty, having home insurance transforms unforeseen risks into manageable challenges. It is an investment in both your financial well-being and your family’s safety.

Insurance

Auto Insurance: Essential Guide to Protection, Coverage, and Savings

Introduction to Auto Insurance

Auto insurance is more than just a legal requirement—it is a financial shield that protects you, your vehicle, and others on the road. With millions of cars on highways worldwide, accidents and damages are unpredictable. Having the right auto insurance ensures you are safeguarded against unexpected financial burdens while also staying compliant with the law.

In this guide, we will explore everything about auto insurance, from coverage types to factors affecting premiums, and tips to save money without compromising protection.

What is Auto Insurance?

Auto insurance is a contractual agreement between you and an insurance provider. You pay regular premiums, and in exchange, the company offers financial protection for accidents, theft, or damages. This policy covers liability, medical expenses, and repair costs, depending on the plan you choose.

Why Auto Insurance is Important

- Legal Requirement – Most countries and states mandate auto insurance for all drivers.

- Financial Protection – Covers costly expenses from accidents or damages.

- Peace of Mind – Ensures you are prepared for unexpected events.

- Third-Party Coverage – Protects other drivers, passengers, and pedestrians in case of an accident.

Types of Auto Insurance Coverage

1. Liability Coverage

Liability insurance covers bodily injury and property damage caused to others in an accident. It is mandatory in most places.

2. Collision Coverage

This covers damages to your own car resulting from collisions, regardless of who was at fault.

3. Comprehensive Coverage

Provides protection against non-collision incidents like theft, vandalism, natural disasters, and fire.

4. Personal Injury Protection (PIP)

Covers medical expenses for you and your passengers, regardless of fault.

5. Uninsured/Underinsured Motorist Coverage

Protects you if you’re involved in an accident with a driver who has little or no insurance.

Factors Affecting Auto Insurance Premiums

- Driving History – Clean records usually mean lower premiums.

- Age and Gender – Younger drivers often face higher rates due to less experience.

- Location – Urban areas with high traffic may have higher insurance costs.

- Type of Vehicle – Expensive cars often have higher premiums due to costly repairs.

- Credit Score – In some regions, credit history influences insurance rates.

- Coverage Limits – Higher coverage levels increase premium costs.

How to Choose the Right Auto Insurance Policy

- Assess Your Needs – Consider your car’s age, driving habits, and budget.

- Compare Quotes – Always evaluate multiple insurers before making a decision.

- Check Exclusions – Understand what the policy does not cover.

- Evaluate Deductibles – Higher deductibles can lower premiums but increase out-of-pocket costs.

- Look for Discounts – Many insurers offer safe driver, multi-policy, and student discounts.

Benefits of Having Auto Insurance

- Financial Security – Covers costly repairs and medical bills.

- Legal Compliance – Protects you from penalties for driving uninsured.

- Stress-Free Driving – Reduces anxiety about accidents and unexpected expenses.

- Customized Options – Policies can be tailored to your needs.

Common Mistakes to Avoid When Buying Auto Insurance

- Choosing the Cheapest Option Only – Low cost may mean limited coverage.

- Not Reading the Policy – Overlooking terms and conditions can cause problems later.

- Skipping Add-Ons – Options like roadside assistance may be valuable.

- Ignoring Deductibles – Always understand how much you’ll pay in case of a claim.

Tips to Save Money on Auto Insurance

- Bundle auto insurance with home or life insurance.

- Maintain a clean driving record.

- Opt for usage-based insurance if you drive less.

- Take advantage of no-claims bonuses.

- Install safety features in your car for discounts.

The Future of Auto Insurance

With technology evolving, auto insurance is adapting:

- Telematics – Usage-based policies track driving behavior through apps.

- AI and Big Data – Insurers use data to provide personalized rates.

- Electric Vehicle Coverage – Special policies for EVs are gaining popularity.

Conclusion

Auto insurance is not just a financial product—it is a safeguard that ensures safety, compliance, and peace of mind. Choosing the right coverage requires research, awareness, and understanding of your needs. By knowing the types of coverage, factors affecting premiums, and ways to save money, drivers can make informed decisions and stay protected on the road.

-

Biography5 months ago

Biography5 months agoKristi Noem Height: Everything You Need to Know About the South Dakota Governor

-

Biography5 months ago

Biography5 months agoOrlando Schwerdt: A Deep Dive into His Life and Legacy

-

Biography4 months ago

Biography4 months agoJann Mardenborough Accident: A Defining Moment in His Racing Journey

-

Biography4 months ago

Biography4 months agoAlexis Danson: Inspiring Journey of Talent and Resilience

-

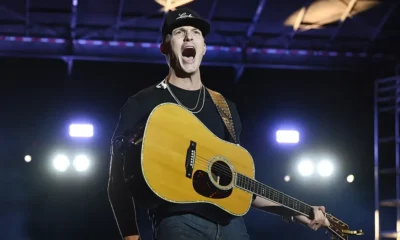

Celebrat5 months ago

Celebrat5 months agoParker McCollum Height: Everything You Need to Know About the Country Star

-

Biography5 months ago

Biography5 months agoRobert Peston Illness: Grief, Autoimmune Response & Mental Health Journey

-

Biography5 months ago

Biography5 months agoMarten Glotzbach: Life, Career, and Inspiring Journey

-

Biography5 months ago

Biography5 months agoElsie-Rose Thomas: A Rising Star You Need to Know About